Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

At 0.6661, the bulls are in charge and the bird of 0.5% higher on Thursday's business in the remaining hour or so of the North American session. The price has climbed from a low of 0.6609 to score a high of 0.6681 so far as traders await the outcome of Friday's US Nonfarm Payrolls event.

Thursday's focus was on the two central banks meeting, the Bank of England, which hiked by 0.25%, and the European Central Bank which sounded off a more hawkish than expected tone.

''The Kiwi is higher this morning, riding on the coattails of the EUR, which surged following comments from ECB President Lagarde that were perceived as hawkish. For the most part, Kiwi was an outperformer overnight, and only really lost ground to the EUR,'' analysts at ANZ Bank explained.

''The overall magnitude of the Kiwi rally was pretty tame though, which is probably to be expected ahead of key US jobs data tonight that has the potential to marginally reshape expectations for Fed policy, which will in turn have a bearing on the USD.''

The focus will now be on Friday's Nonfarm Payroll and the Bank of Australia's Statement of Monetary Policy, (SoMP).

The US NFP could throw more fuel on the US dollar bear's fire. Payrolls likely plunged in January, but only because of temporary Omicron fallout. However, despite the Federal Reserve being expected to look through any near term weakness in the labour market, ''if labour market weakness persists for a couple of months beyond this, then the Fed will rethink its likely rate path,'' analysts at Brown Brothers Harriman argued.

As for the SoMP, this will be monitored by NZD traders for any signs of bias one way or the other that could lead to volatility in the antipodeans on Friday. ''For now, it’s a global, rather than local, story for the Kiwi now that key data is out of the way, with 3wks to run to the RBNZ MPSm'' analysts at ANZ bank said in the note.

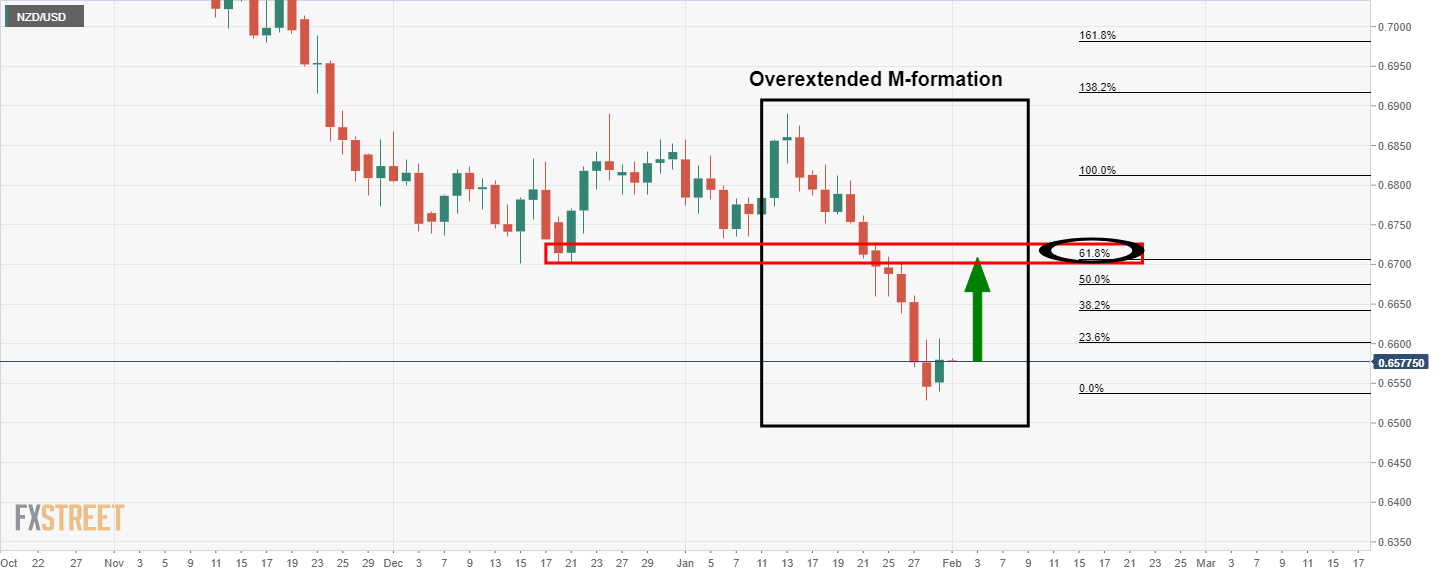

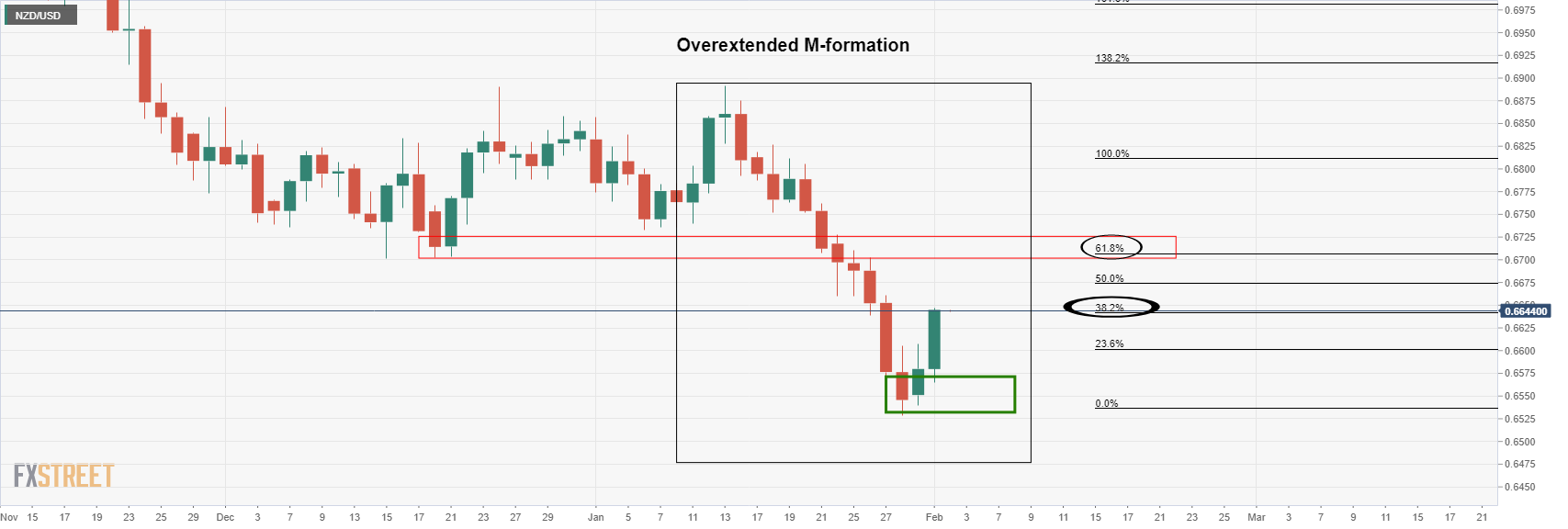

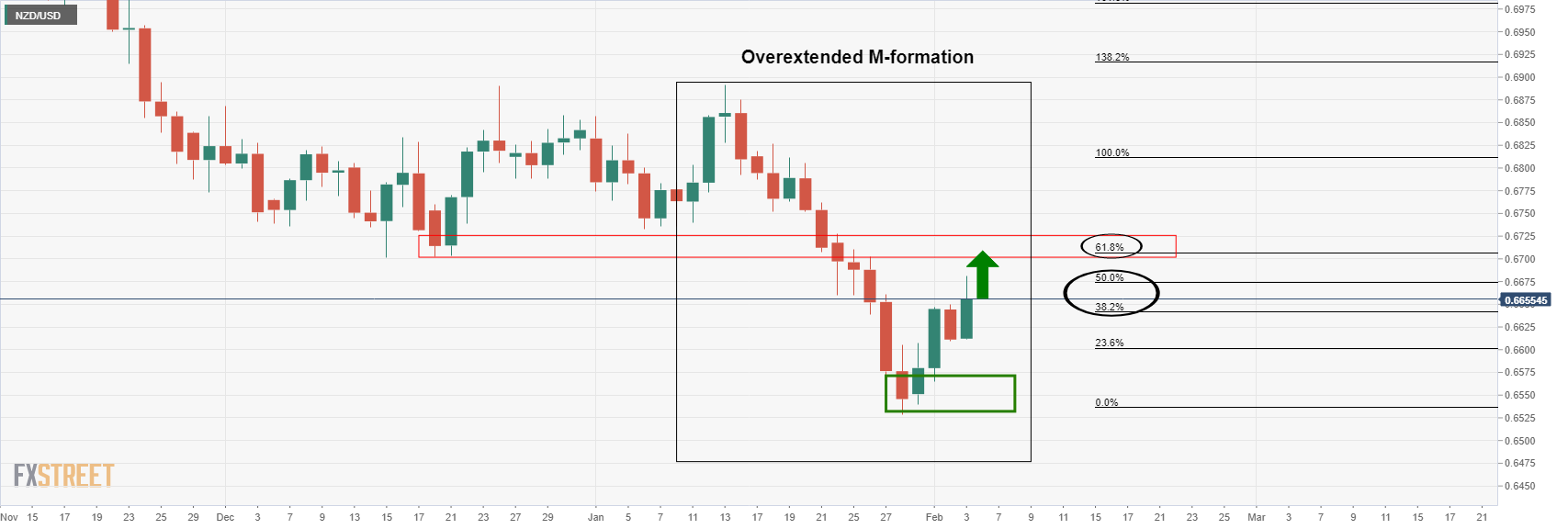

Meanwhile, the upside is playing out as forecasted in the prior analysis as follows:

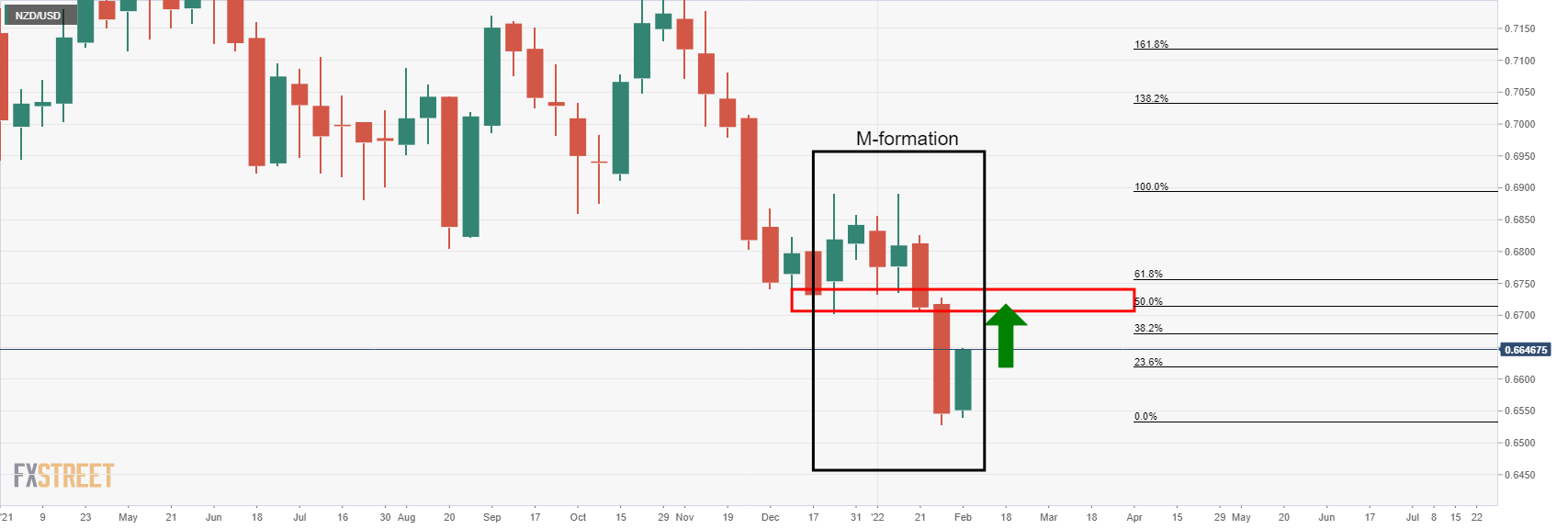

NZD/USD Price Analysis: Bulls eye a 61.8% golden ratio in the 0.67 area

''A 50% mean reversion of the weekly bearish leg of its own M-formation aligns with the daily target in the low 0.67 area.''

The price has now met the daily chart's 50% mean reversion mark as well. A daily bullish close will underpin the bullish bias for a run to the 61.8% golden ratio, potentially to be achieved around the NFP event before the week is out.