Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

Developing Story

The Reserve Bank of Australia's highly anticipated event has just occurred whereby the RBA was expected to end its pandemic-related bond-buying program.

Market participants had speculated that policymakers would bring forward rate hikes’ guidance, potentially offering fresh incentives for AUD traders. The conundrum for the markets was how much of such an outcome has already been priced in and whether Governor Lowe would push back at market expectations of progressive rate hikes this year.

More to come...

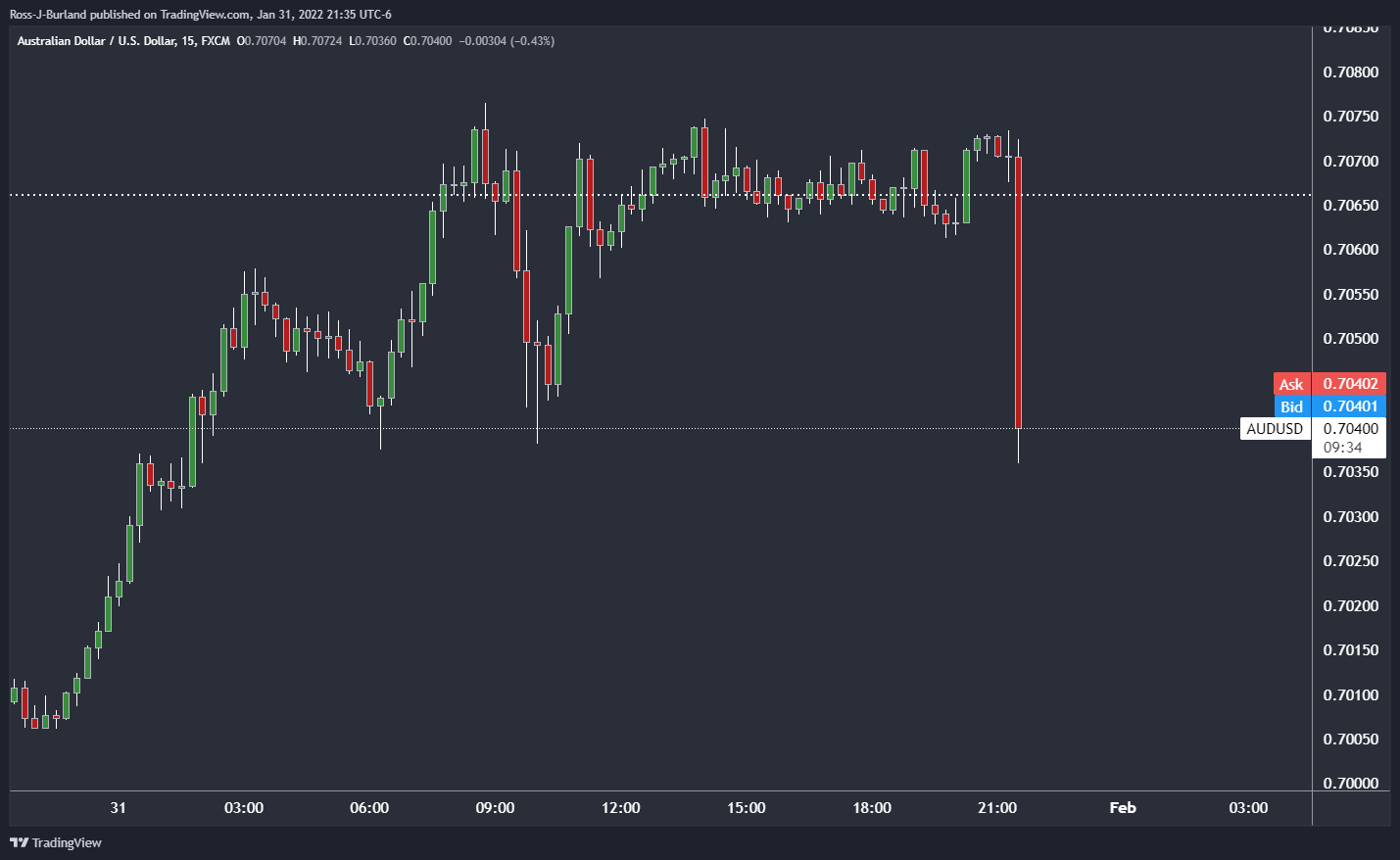

(15-min chart)

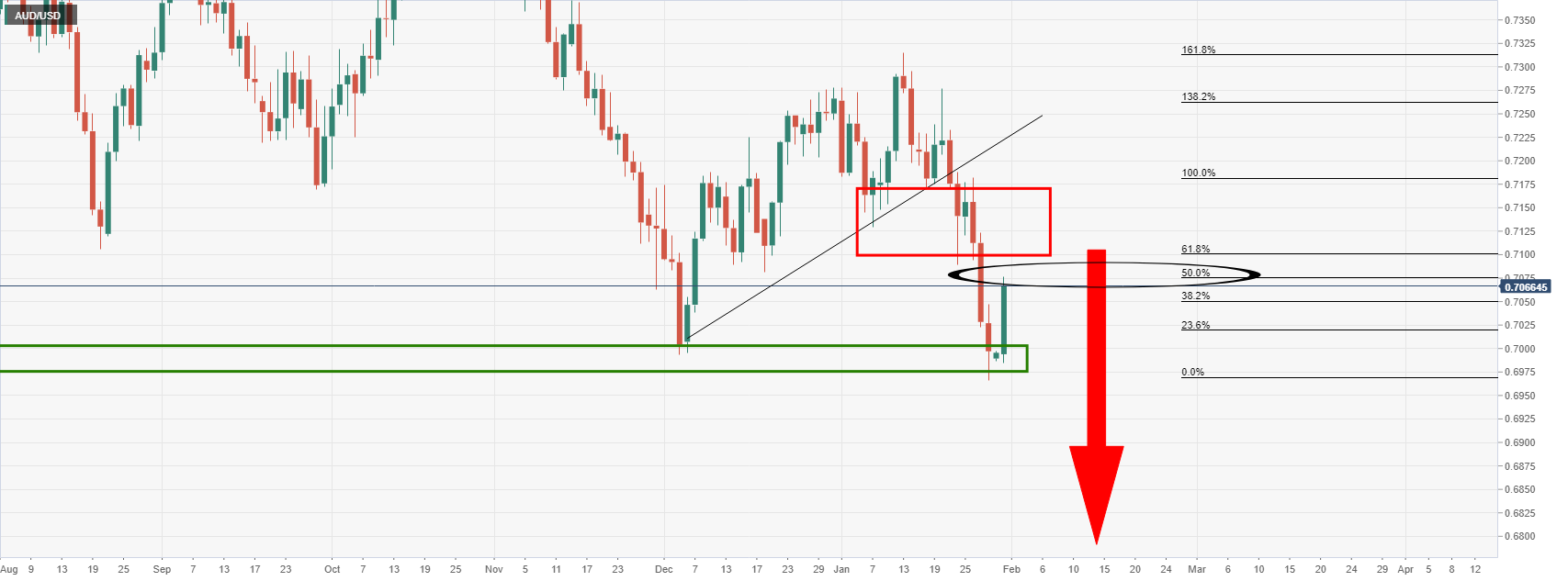

Prior to the event, the following analysis acknowledged the upside correction in the Aussie in the wake of US dollar weakness: AUD/USD Price Analysis: Bulls move in on a critical liquidity zone

As illustrated, the price had moved in on the forecasted target zone, but more to come from the bulls in the days to come prior to the next test of the 0.6950s was anticipated.

More to come....

RBA Interest Rate Decision is announced by the Reserve Bank of Australia. If the RBA is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the AUD. Likewise, if the RBA has a dovish view on the Australian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Decisions regarding this interest rate are made by the Reserve Bank Board, and are explained in a media release which announces the decision at 2.30 pm after each Board meeting.