Fed's Kashkari: Not seeing evidence yet of high inflation readings

Federal Reserve's Neel Kashkari stated that most of the high inflation we are seeing is in a few sectors.

As the economy returns more to normal, price increases will level off.

He's not seeing evidence yet of high inflation readings driving up inflation expectations.

He also said that the cryptocurrency market is akin to the "wild west", is "full of nonsense".

Meanwhile, the US dollar has ignored these comments as the market prices for the Nonfarm Payrolls event on Friday and having already picked up a bid on hawkish comments from Fed members earlier the week.

Yesterday, Vice-Chair Clarida said, “if my baseline outlook does materialize, then I could certainly see supporting announcing a reduction in our purchases later this year.”

The “necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022,” he added arguing that the inflation outlook risks are to the upside.

''He rarely dissents from the Fed's chairman, Jerome Powell, and so we view this as a sign that the Fed Chair is also moving in this direction,'' analysts at Brown Brothers Harriman said.

- Fed's Kaplan: Taper of Fed's bond purchases should start soon and be gradual

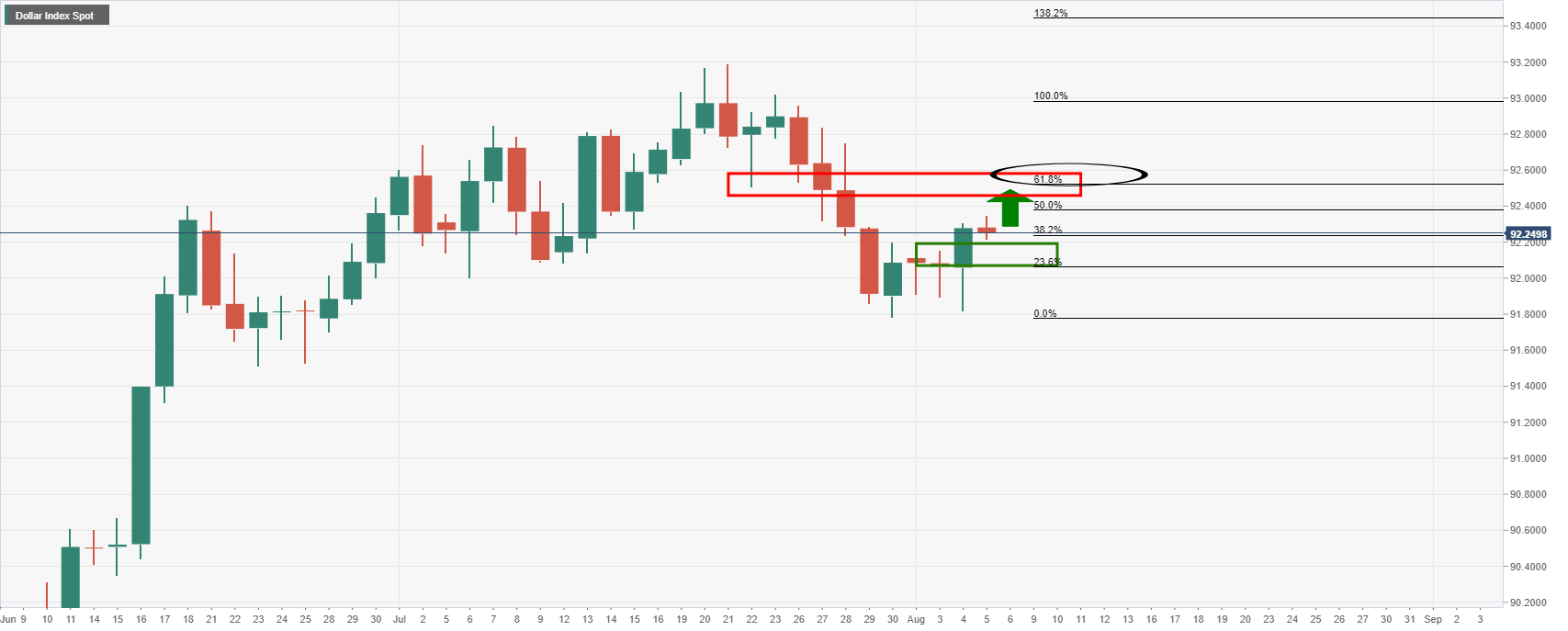

The chart below illustrates the current bullish trajectory in the US dollar, DXY index where the price would be expected to travel to on a bullish outcome from the NFP on Friday:

On the other hand, there is potential for a disappointment in contrast to the current hawkish narrative from the Federal Reserve.

In such a scenario, this would be expected to hurt the greenback and potentially send it over the cliff into the abyss to test the 90.50/40s area: