AUD/USD bears in control for the open

- AUD/USD bears are back in town as the price fails to rally beyond resistance.

- RBA, covid, Fed, China, iron ore and US jobs data are all critical for the week ahead.

AUD/USD ended the day on Friday under heavy pressure, down 0.7% falling from a high of 0.7404 to a low of 0.7331.

The US dollar picked up a bid as investors switched their outlook on the back of St. Louis Federal Reserve President James Bullard arguing that the Fed should start reducing its $120 billion in monthly bond purchases this fall and cut them "fairly rapidly" so the program ends in the first months of 2022 to pave the way for a rate increase that year if needed.

The comments sent the US dollar rallied back into the 92 handle and took down the commodity complex with a thud. DXY rose from a low of 91.78 to a high of 92.201 to end the day higher by 0.23% at 92.090.

However, the index was down 0.8% for the week, on pace for its worst weekly performance since the first week of May.

Following the Fed’s chair Jerome Powell’s comments in the presser, concluding the FOMC’s two-day meeting, markets will be watching US data very closely in the next couple of weeks leading into the 26-28 Aug Jackson Hole Symposium.

Tapering was mentioned in the official statement for the first time this cycle, with the Fed noting that there has been progress made towards the goals laid out to justify tapering.

This was a very hawkish surprise which has indicated a shorter timeline for actual tapering. An explicit tapering statement could be therefore made at the Jackson Hole followed by actual tapering seen by year-end.

This makes the forthcoming week’s Nonfarm Payrolls a critical event for both the US dollar and gold prices. An improvement in the data will likely firm bets of a tapering announcement later in the month and be supportive of the greenback.

Additionally, the Chinese government’s regulatory clampdown generated a risk-off wave that spread across Asian and global markets, sucking liquidity out of EMs which is AUD bearish USD bullish.

On balance, that combined with the week’s dataflow and Fed tapering expectations should result in a stronger dollar across the board could be seen for the open.

Moreover, domestically the fundamental backdrop is bearish for the currency.

Iron ore prices reverted to May’s lows after China continued to curb steel production as the nation attempts to reduce pollution.

The imposition of a tariff on steel exports is a weight for AUD.

This week's Reserve Bank of Australia interest rate decision where the recent lockdowns will mean the RBA will revert from sounding hawkish is also a headwind.

The RBA is not expected to make any amendments to the current policy stance after the adjustments announced in early July.

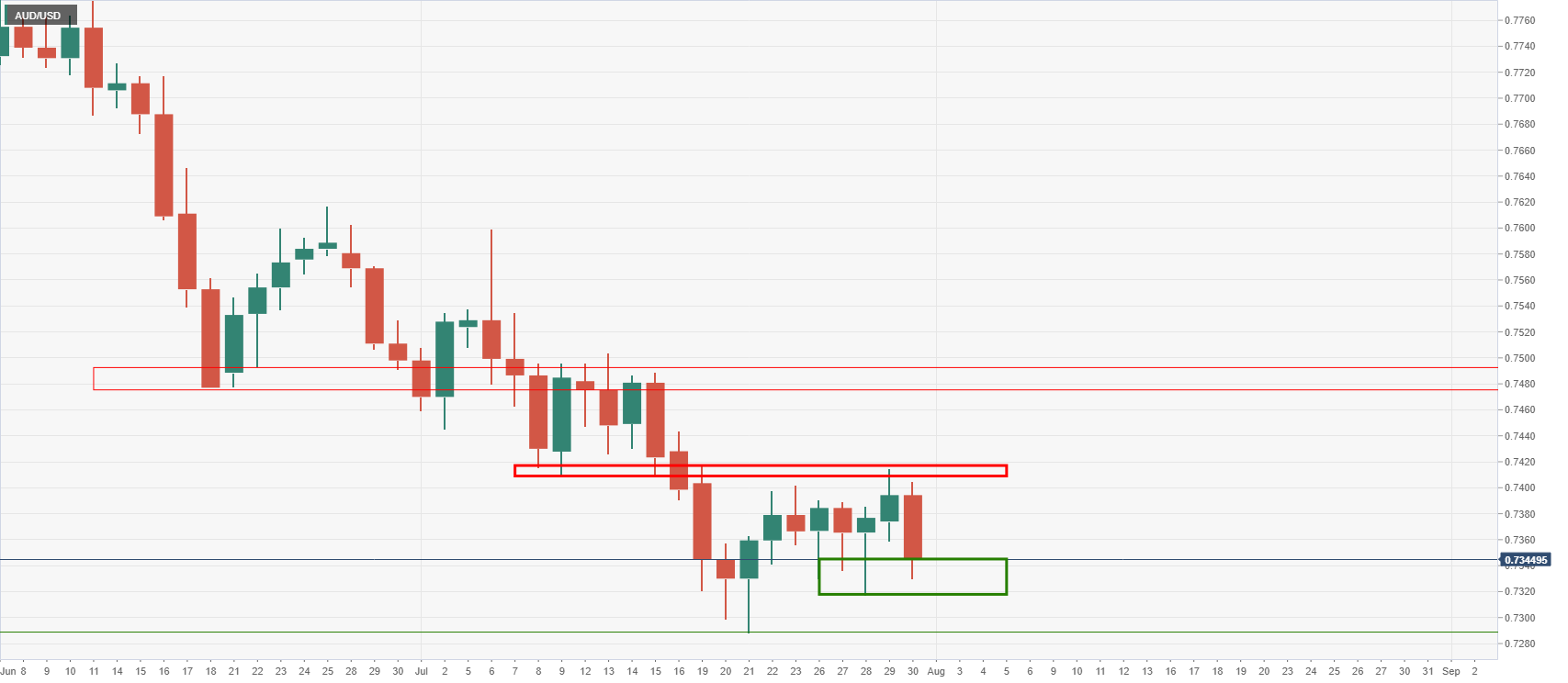

AUD/USD technical analysis

despite a recent glitch in US dollar weakness, the technical bias has been strongly bearish for AUD/USD over recent weeks.

The currency is on the brink of its extending the weekly decline from above the 0.77 level and bears eye a break of daily support to open the path to a lower low within this cycle.

4-hour chart

The prospects for a breakout and possible price action are illustrated above from a 4-hour perspective.