AUD/USD Price Analysis: Bulls coming up for their last breath?

- AUD/USD bears are being squeezed by a strong bullish counterattack.

- Traders will be applying their risk management plans in a trapped environment.

In contrast to the start of the week's analysis, Chart of the Week: Commodity currencies in focus, bears in control, the bears have been wrong-footed in European and US markets and are now trapped.

The following illustrates the scenario and outlines three possible outcomes from a trader's perspective dealing with the current price action.

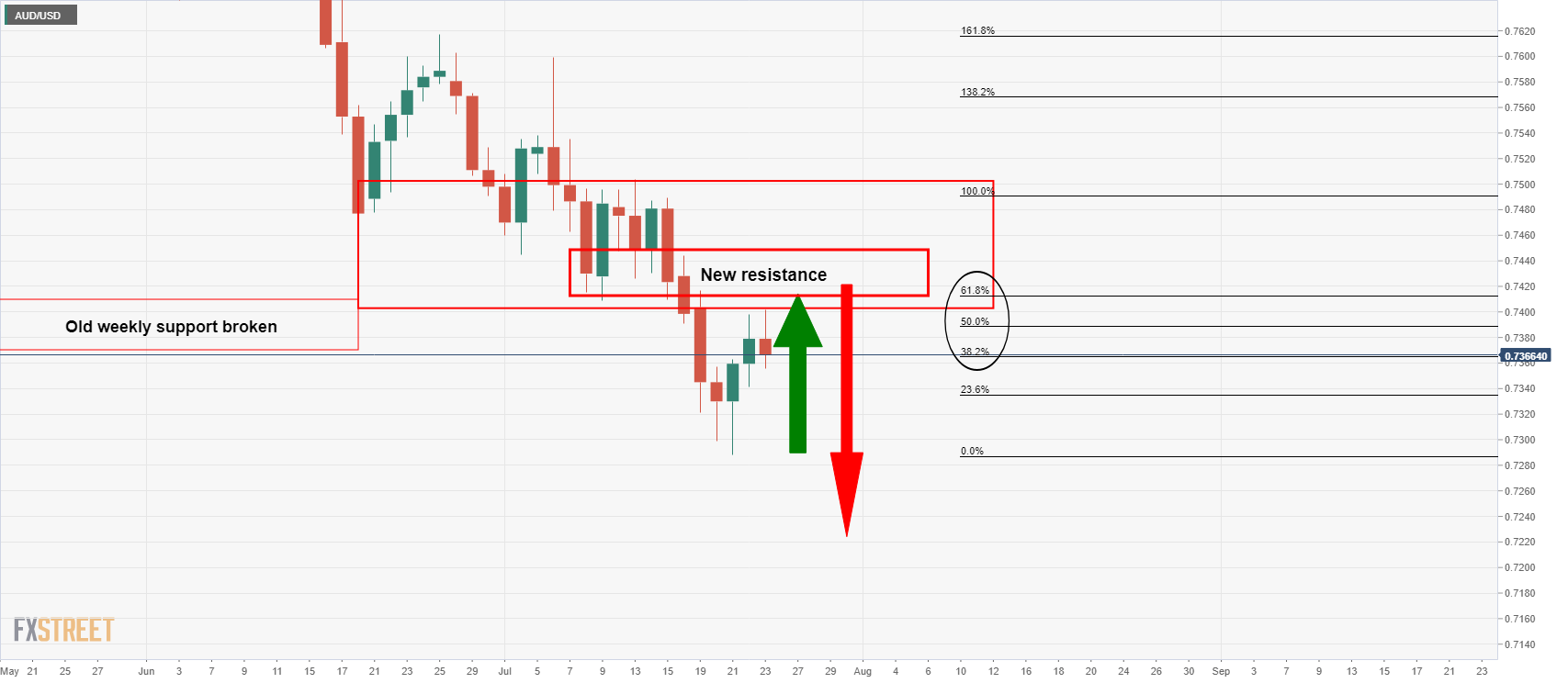

Prior analysis, daily and 4-hour charts

On a daily perspective, the price has corrected 50% from the prior bearish impulse near 0.7390 and bears are looking for an imminent optimal short entry point on the lower time frames:

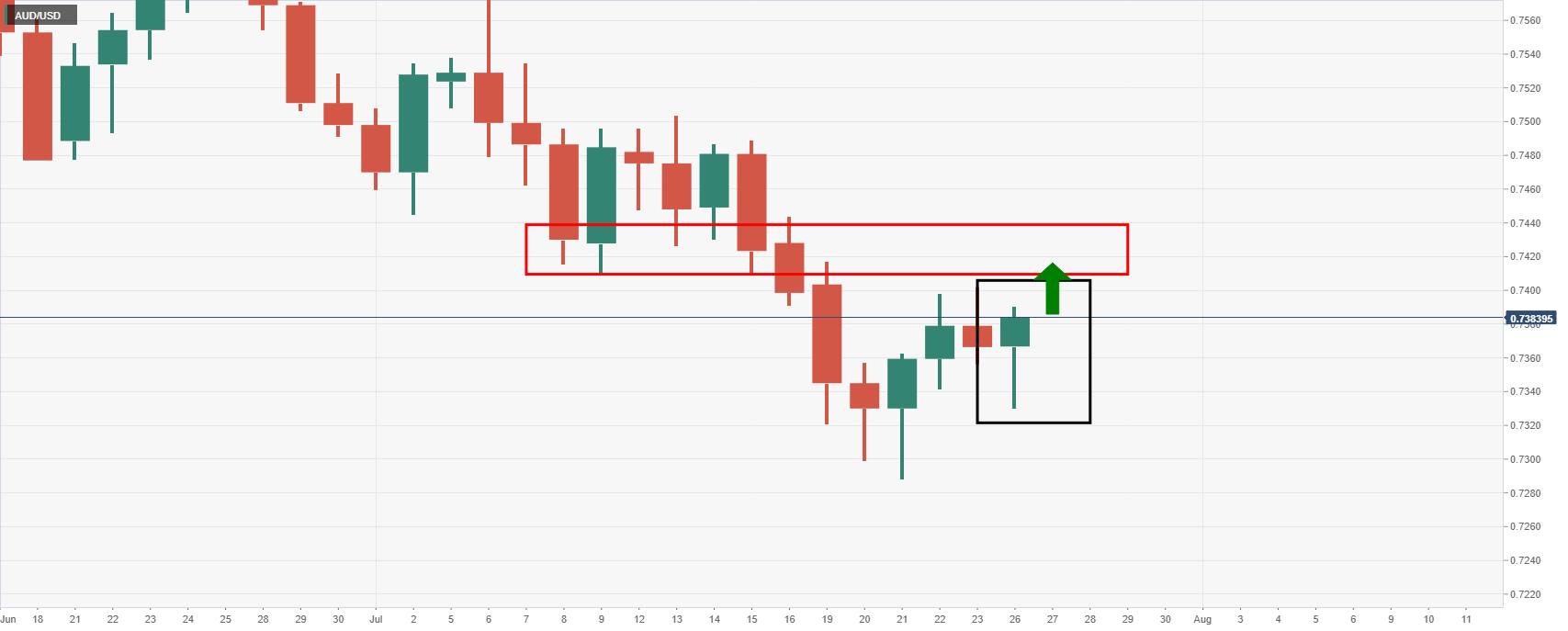

The 4-hour chart shows that the price is on the verge of breaking support below the 21 four-hour Exponential Moving Average (EMA)...

Live daily, 4-hour and 1-hour charts

Following the prior analysis, the price did indeed act in accordance with the downside projections, but bulls have steeped and life uncomfortable to bears that are now trapped between resistance and support.

The daily chart above shows that the price initiated the downside bias at the start of the week but the bulls jumped in to cap the bear's first attempt.

The 4-hour chat below illustrates how the bears are now trapped between where the sell limit was triggered and the follow-through to test the bear's commitments at 4-hour resistance.

The bias is to a restest of the prior resistance structure that would be now expected to act as support near 0.7370 and troubling for the bears.

At this juncture, the most prudent action from the bears would be to move their take profit target to entry and get out at best breakeven on a restest of the entry point. In doing so, they live to trade another day.

Alternatively, considering the broader downside bias, bears can opt to hold the position in negative territory and rely on their stop loss placement above 4-hour resistance.

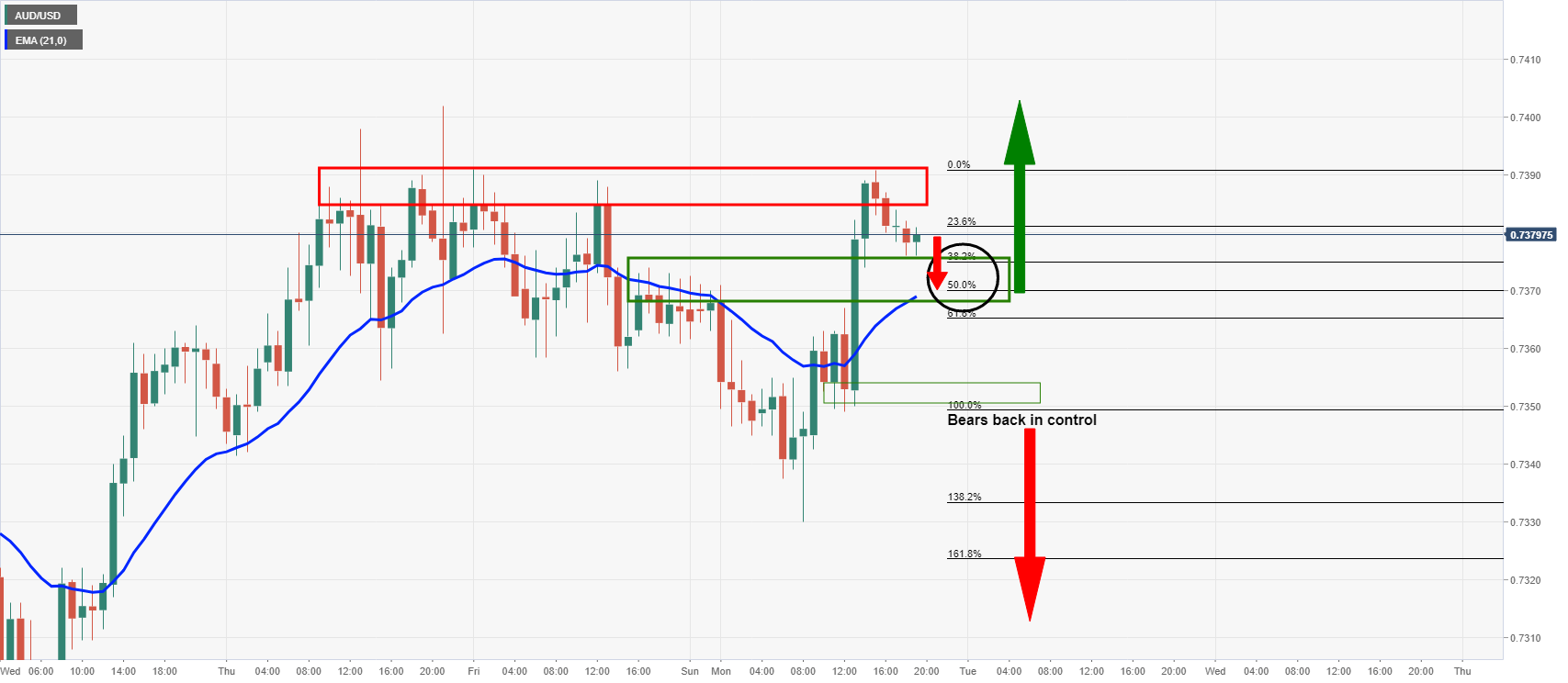

Lastly, and the riskiest alternative is to trade with the bullish momentum on the hourly chart:

If the price continues to correct to support, (21-EMA / 50% mean reversion confluence), there could be an opportunity to reverse the position, taking a partial loss initially and targeting an upside extension through resistance.

However, ideally, the original short entry point will be met before fresh hourly bullish conditions above it and traders can simply go back to the drawing board breakeven.

On a retest below fresh support structure, the bears will be back in control and be able to position for a second attempt a downside extension, as per the original analysis:

Chart of the Week: Commodity currencies in focus, bears in control