Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

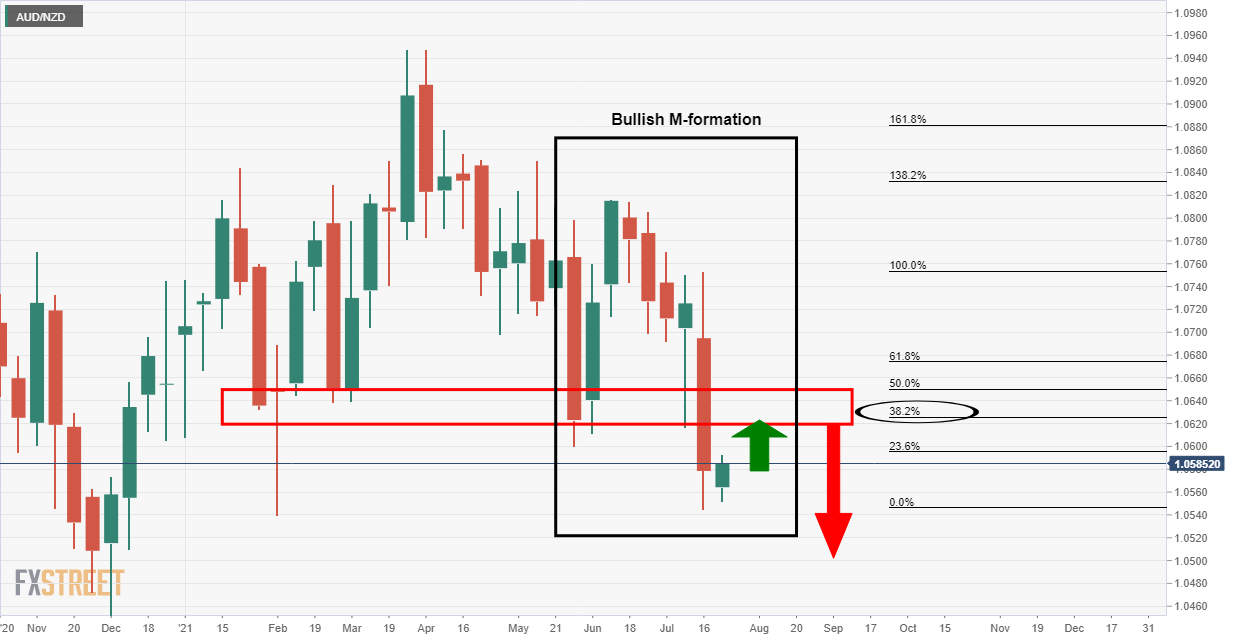

Bears are fading the rallies and building a short position due to the divergence between the Reserve Bank of Australia and Reserve Bank of New Zealand.

As per the prior analysis, AUD/NZD Price Analysis: A fade on rallies in the making, the price did indeed move higher with reluctance.

''... fading from the late May lows should be monitored for bearish structure and shorting opportunities:

As illustrated, the price has indeed gone to meet the projected resistance target and has since offered bears downside opportunities in the subsequent drop.

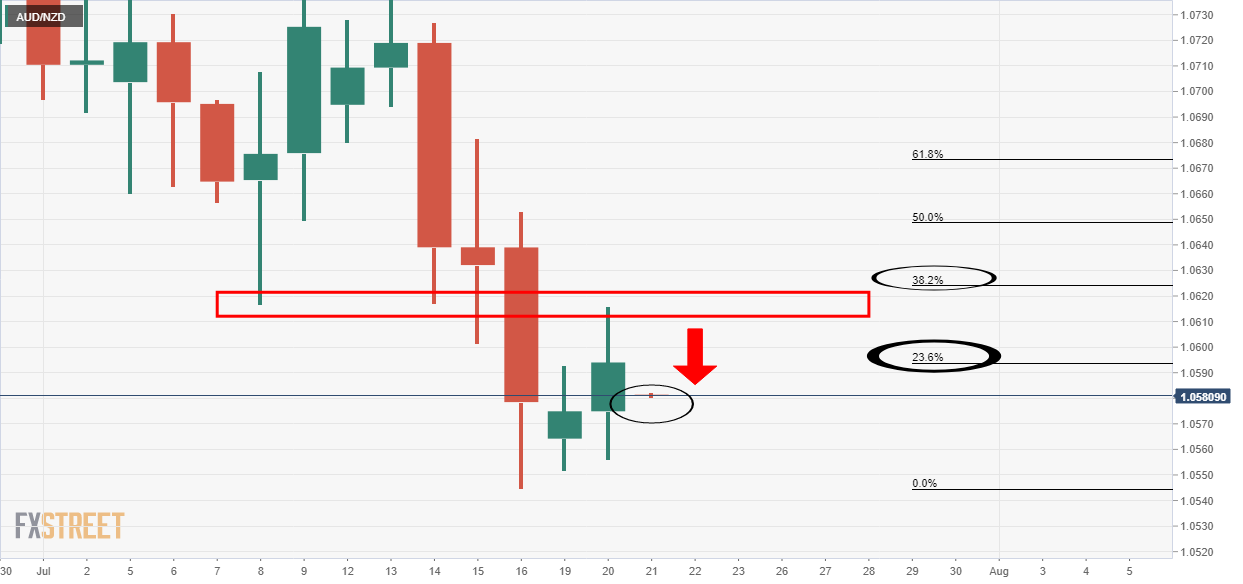

With that being said, there are still prospects of a deeper correction to test higher up the scale of the Fibonaccis, with the 38.2% Fibo still left intact and compelling for a test.

In doing so, it would coincide with a more comprehensive study of the longer-term charts and potentially fuel a strong downside decline in the grander scheme of things, in line with the broader bearish trend.

''From a weekly perspective, the bulls are currently correcting last week's bearish impulse and there could be more on the cards.

The M-formation is a high completion rate pattern where the price would be expected to test at least the 38.2% Fibonacci retracement which has a confluence of prior lows near 1.0620.''

The bears, at which point, will be on the lookout for bearish conditions from which to short and target a downside extension towards the first half of 2020's business resistance between 1.0505/30.