Gold Price Analysis: XAU/USD eyes $1,936 as next bullish target – Confluence Detector

- XAU/USD has been grinding its way higher amid quiet holiday trading.

- The Confluence Detector is showing that gold's path of least resistance is up.

- Gold Weekly Forecast: XAU/USD bulls not yet ready to give up on additional gains

Does gold serve as a hedge against inflation or will higher returns on US debt make the yieldless precious metal worth less? That debate rages on and XAU/USD continues its upward march. Core PCE, the Federal Reserve's preferred gauge of inflation, shot higher to 3.1%, causing whiplash in stock markets. While that volatility in equities may return on Tuesday, the long Memorial Day weekend is providing some calm on Monday.

Where next for gold price from here?

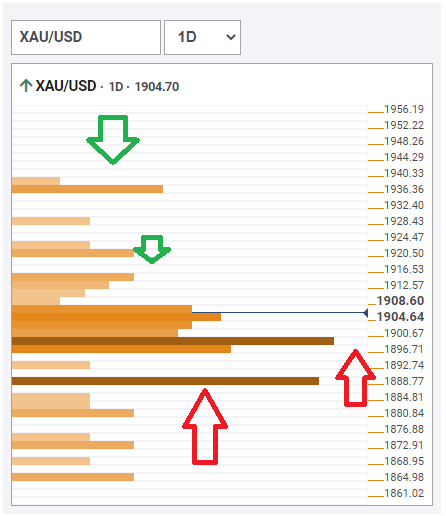

The Technical Confluences Detector is showing that XAU/USD faces some resistance at $1,914, which is the convergence of the previous week't high, the Bollinger Band 1h-Upper, the Pivot Point one-day Resistance one and other lines.

Further above, the upside target is $1,936, which is the meeting point of the PP one-day R3 and the PP one-week R2.

Strong support awaits at $1,898, which is a dense cluster including the Fibonacci 38.2% one-day, the Fibonacci 38.2% one-week, the Simple Moving Average 100-1h, and the SMA 200-15m.

Next down the line, $1,888 is another substantial cushion. It is the confluence of the SMA 200-1h, the SMA 50-4h, the Fibonacci 61.8% one-week, the PP one-day S1 and the BB 4h-Lower.

All in all, the path of least resistance is up – support lines are stronger than resistance ones.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence