GBP/USD Price Analysis: Refreshes session tops, bulls eyeing 1.3900 confluence region

- GBP/USD staged a solid rebound from the 1.3800 mark amid renewed USD selling bias.

- The 1.3900 confluence support breakpoint might cap gains amid the UK political jitters.

- Bears need to wait for a sustained break below the 1.3800 mark before placing fresh bets.

The GBP/USD pair built on its steady intraday ascent through the mid-European session and climbed to fresh daily tops, around the 1.3875-80 region in the last hour.

The US dollar struggled to preserve its modest intraday gains, instead met with some fresh supply at higher levels amid expectations that the Fed will keep interest rates low for a longer period. Apart from this, a strong rally in the US equity futures further undermined the safe-haven greenback.

This, in turn, was seen as a key factor that assisted the GBP/USD pair to find decent support and stage a goodish rebound from two-week lows, around the 1.3800 mark touched earlier this Monday. That said, the risk posed by the Scottish elections might cap any further gains for the GBP/USD pair.

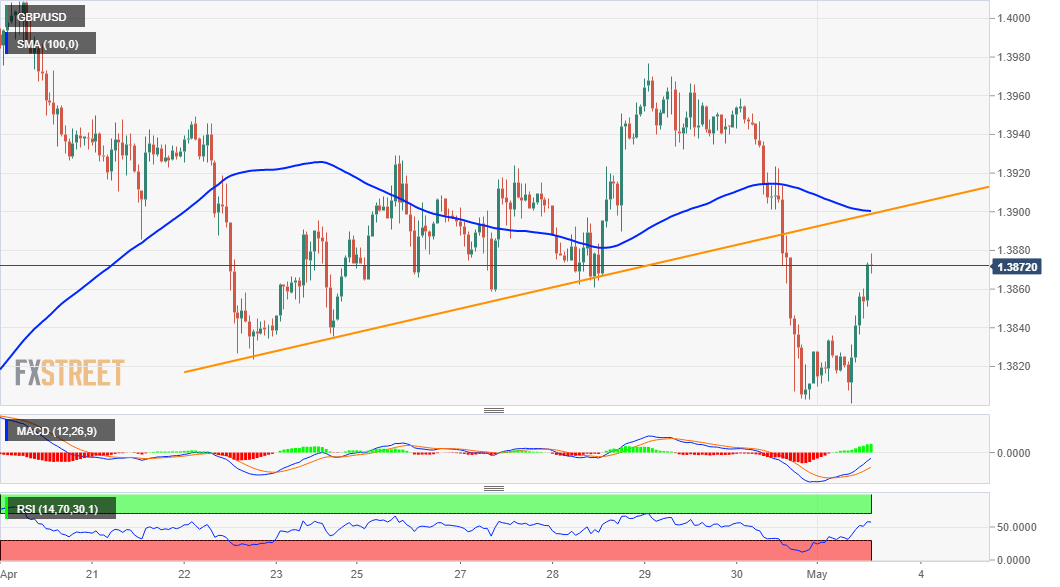

From a technical perspective, any subsequent positive move is likely to confront stiff resistance near the 1.3900 round-figure mark. The mentioned handle comprises of 100-hour SMA and an ascending trend-line support breakpoint, which should now act as a key pivotal point for short-term traders.

Meanwhile, technical indicators on 4-hour/daily charts are yet to catch up with the strong intraday positive move. This, in turn, warrants some caution for aggressive bullish traders and positioning for any further appreciating move ahead of the Fed Chair Jerome Powell's speech later this Monday.

That said, a sustained strength beyond the 1.3900 mark has the potential to lift the GBP/USD pair back towards the 1.3925-30 horizontal resistance. Some follow-through buying will set the stage for a move towards last week's swing high, around the 1.3975 region en-route the key 1.4000 psychological mark.

On the flip side, the 1.3835-30 region now seems to protect the immediate downside. This is closely followed by the 1.3800 mark, which if broken decisively will be seen as a fresh trigger for bearish traders and turn the GBP/USD pair vulnerable to slide further towards mid-1.3700s.

The downward trajectory could further get extended and expose the 1.3700 mark. The GBP/USD pair could eventually drops to test double-bottom support near the 1.3675-70 region.

GBP/USD 1-hour chart

Technical levels to watch