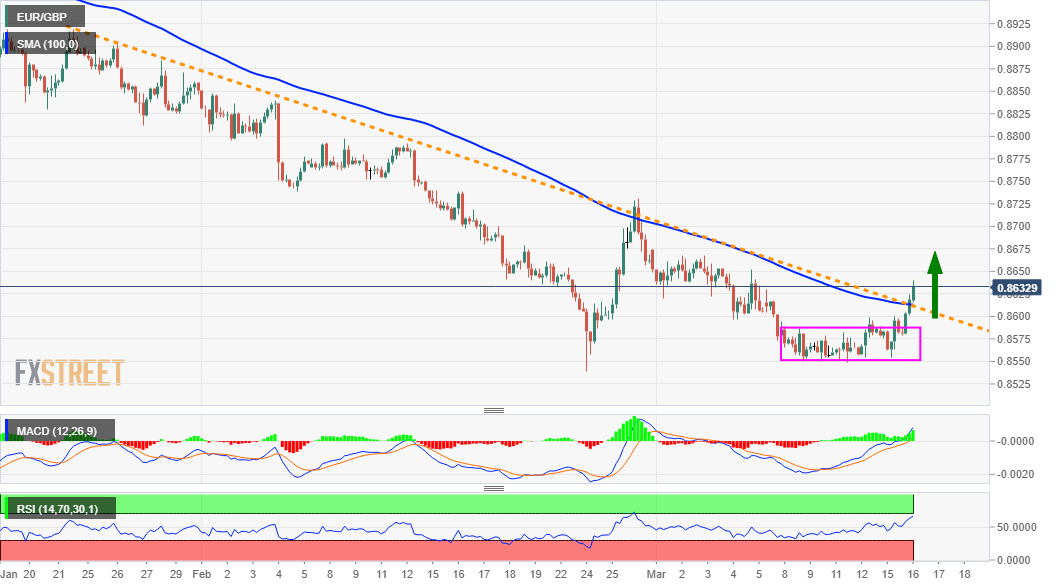

EUR/GBP Price Analysis: Bulls looking to seize control amid descending trend-line breakout

- EUR/GBP gained strong traction on Tuesday and broke through a one-week-old trading range.

- The set-up supports prospects for additional gains towards the 0.8665 intermediate resistance.

- The emergence of some dip-buying should help limit the downside near the 0.8600 round-figure.

The EUR/GBP cross continued scaling higher through the first half of the European session and shot to one-and-half-week tops, around the 0.8640 region in the last hour.

Tuesday's strong positive momentum assisted the cross to confirm a bullish breakout through a one-week-old trading range. A subsequent strength beyond the 0.8615 confluence hurdle suggests that the EUR/GBP cross has formed a strong base near the 0.8550-40 region.

The mentioned barrier comprised of 100-period SMA on the 4-hourly chart and a short-term descending trend-line, extending from January 22 highs. This, in turn, might have already set the stage for an extension of the ongoing recovery move from multi-month lows.

The constructive set-up is reinforced by the fact that technical indicators on the 4-hourly chart have been gaining positive traction. That said, oscillators on the daily chart – though have recovered from the bearish territory – are yet to confirm the bullish outlook.

Nevertheless, the EUR/GBP cross now seems poised to build on intraday gains and climb further towards an intermediate resistance near the 0.8665 region. Some follow-through buying should assist bulls to aim back towards reclaiming the 0.8700 round-figure mark.

On the flip side, any pullback towards the trend-line/100-period SMA confluence resistance breakpoint could now be seen as a buying opportunity. This, in turn, should help limit the downside near the recent trading range hurdle, around the 0.8600 mark.

EUR/GBP 4-hourly chart

Technical levels to watch