Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

The USD/CHF pair caught some fresh bids on Wednesday and has now moved back closer to near four-month tops touched in the previous session.

A fresh leg up in the US Treasury bond yields helped revived the US dollar demand. Apart from this, the prevalent risk-on mood undermined demand for the safe-haven Swiss franc and provided a goodish lift to the USD/CHF pair.

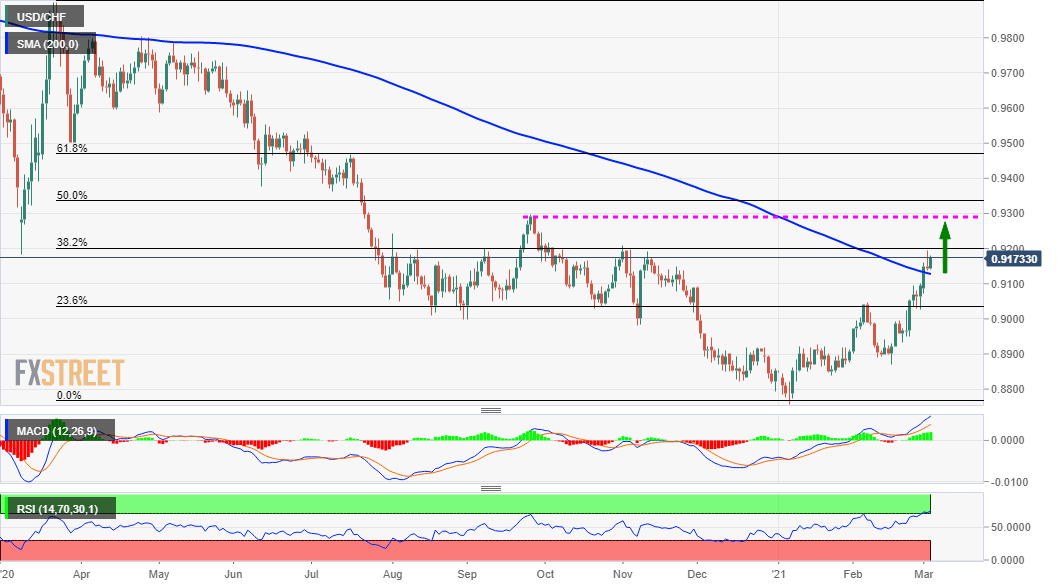

From a technical perspective, the overnight pullback from the vicinity of the 0.9200 mark, or a resistance marked by the 38.2% Fibonacci level of the 0.9902-0.8758 downfall, stalled near the very important 200-day SMA.

The emergence of some dip-buying and acceptance above a technically significant moving average supports prospects for additional gains. That said, slightly overbought RSI on the daily chart warrants some caution for bullish traders.

This makes it prudent to wait for some near-term consolidation before positioning for an extension of a near two-month-old uptrend. Alternatively, bulls might wait for a sustained move beyond the 0.9200 mark before placing fresh bets.

On the flip side, the 0.9140-30 region (200-DMA) might continue to protect the immediate downside. Any subsequent fall might still be seen as a buying opportunity and remain limited near the 0.9100-0.9090 horizontal support.

This is followed by the 23.6% Fibo. level, around the 0.9040-35 region, which if broken will negate any near-term bullish bias. The USD/CHF pair might then slide below the key 0.9000 psychological mark and test 0.8965-60 support zone.