Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

Revenue (adjusted) USD 33.83 billion vs USD 30.57 billion expected.

Earnings per share (adjusted) USD 1.38 vs USD 1.01 per share expected.

Provision For Credit Loss USD 10.47 billion vs USD 9.15 billion expected.

First and foremost it is important to recognise that JP Morgan Chase beat analyst expectations for the Q2 results released on Tuesday. One of the main headlines was a larger than expected provision for bad loans due to the coronavirus pandemic. The companies EPS is down around 51% vs this time last year but this is to be expected considering the current circumstances. Group revenues rose around 11.5% beating analysts expectations of USD 30.37bln. The market may have been surprised by the companies announcement to suspend its share buyback scheme and this could have contributed to the lacklustre performance in the companies share price at the open. Trading revenues jumped 79% with revenue from fixed-income surging a whopping 99%. So it's clear that the firms trading revenues saved the day.

CEO Jamie Dimon's comments are normally watched very carefully as he does have a reputation for moving the markets. This time out he said:

Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy

However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm. We ended the quarter with massive lossabsorbing capacity - over $34 billion of credit reserves and total liquidity resources of $1.5 trillion, on top of $191 billion of CET1 capital, with significant earnings power that would allow us to absorb even more credit reserves if needed

These comments would have eased the minds of investors as the giant American bank has sufficient excess reserves to weather the storm from the COVID-19 pandemic.

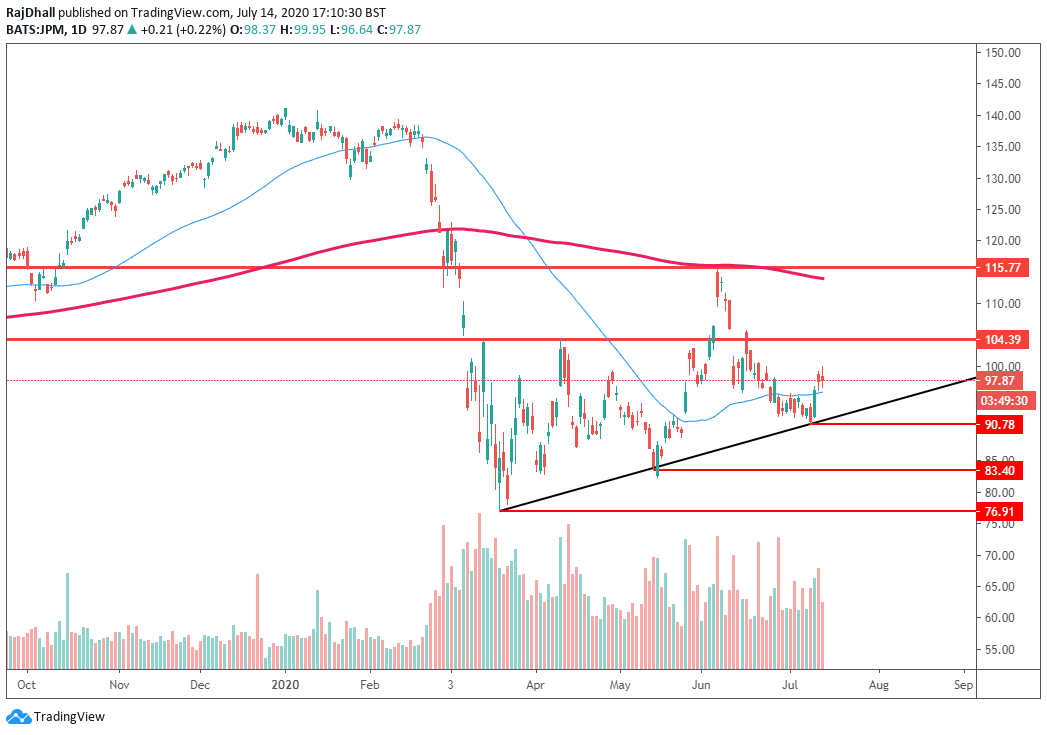

The share price is currently trading (NYSE:JPM) 0.01% higher after gapping up at the open. The chart below shows that the price could just not move above the USD 100.00 psychological level. On the downside, there is some traffic at the 55 Simple Moving Average and the black trendline could also be a support zone. Just underneath that the previous wave low stands at 90.78 and this seems to be a significant level where the price bounced in the past. Looking above current levels, the main support will be the previous consolidation high at USD 104.39 and if that gets breached the next resistance is the wave high at USD 115.77.