Gold Price Analysis: Eyeing $1,747 as the next upside target – Confluence Detector

Gold has been on the rise, edging its way up after consolidating around $1,700. Can it continue higher? The precious metal has robust support and the mutli-year high is already in sight.

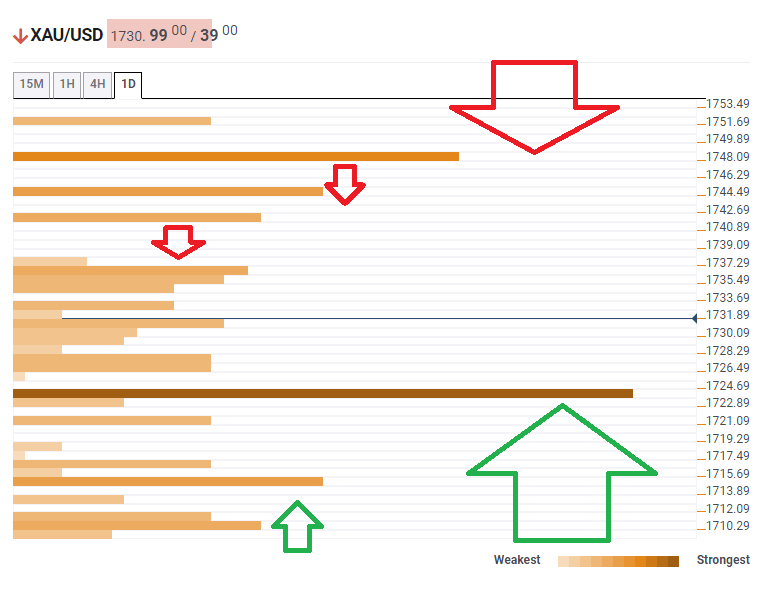

The Technical Confluences Indicator is showing that gold has strong support at $1,722, which is the convergence of the Pivot Point one-week Resistance 1 and the previous weekly high.

Further down, another cushion is at $1,714, which is the meeting point of the Bollinger Band one-hour Lower and the Fibonacci 23.6% one-week.

Looking up, some resistance is at $1,736, which is the confluence of the BB 4h-Upper and the previous daily high.

Further up, $1,740 is another hurdle, where we see the BB 1h-Upper and the PP one-day R1 converge.

The big prize is $1,747, the multi-year high recorded earlier this year, and also close to the Pivot Point one-day Resistance 2.

Here is how it looks on the tool:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence