EUR/USD supported at 1.23 handle post US-data

- The EUR/USD is trading in the 1.23-1.2340 range.

- The US inflation data fails to give the EUR/USD any clear directionality.

The EUR/USD is trading at around 1.2323 virtually unchanged on Thursday as the Easter break will likely see the markets entering smaller ranges.

The next market-moving event should be the inflation numbers in the Eurozone with the Consumer Price Index next Wednesday at 9:00 GMT and the report from the ECB Monetary Policy Meeting Account on Thursday at 11:30 GMT.

Earlier in the session, the US Core Consumer Personal Expenditure (CPE) over the year to February came in line with analysts expectations at 1.6% while in the European session the German Harmonised Index of Consumer Prices year-on-year fell short of expectations and came in at 1.5% against the 1.6% expected. However, today’s data seems to be largely ignored by market participants as the markets seem to be adjusting to month and quarter-end, and the long Easter holiday weekend.

Meanwhile, today’s also saw the US job data with the Initial Jobless Claims to March, 23 coming in at 215K against 230K, which is seen as positive while Continuing Jobless Claims rose from previous readings at 1.871M versus 1.875M expected.

The US Dollar Index (DXY) is consolidating today coiling around the $90 mark after the upmove seen since Tuesday where the DXY was trading at $89.

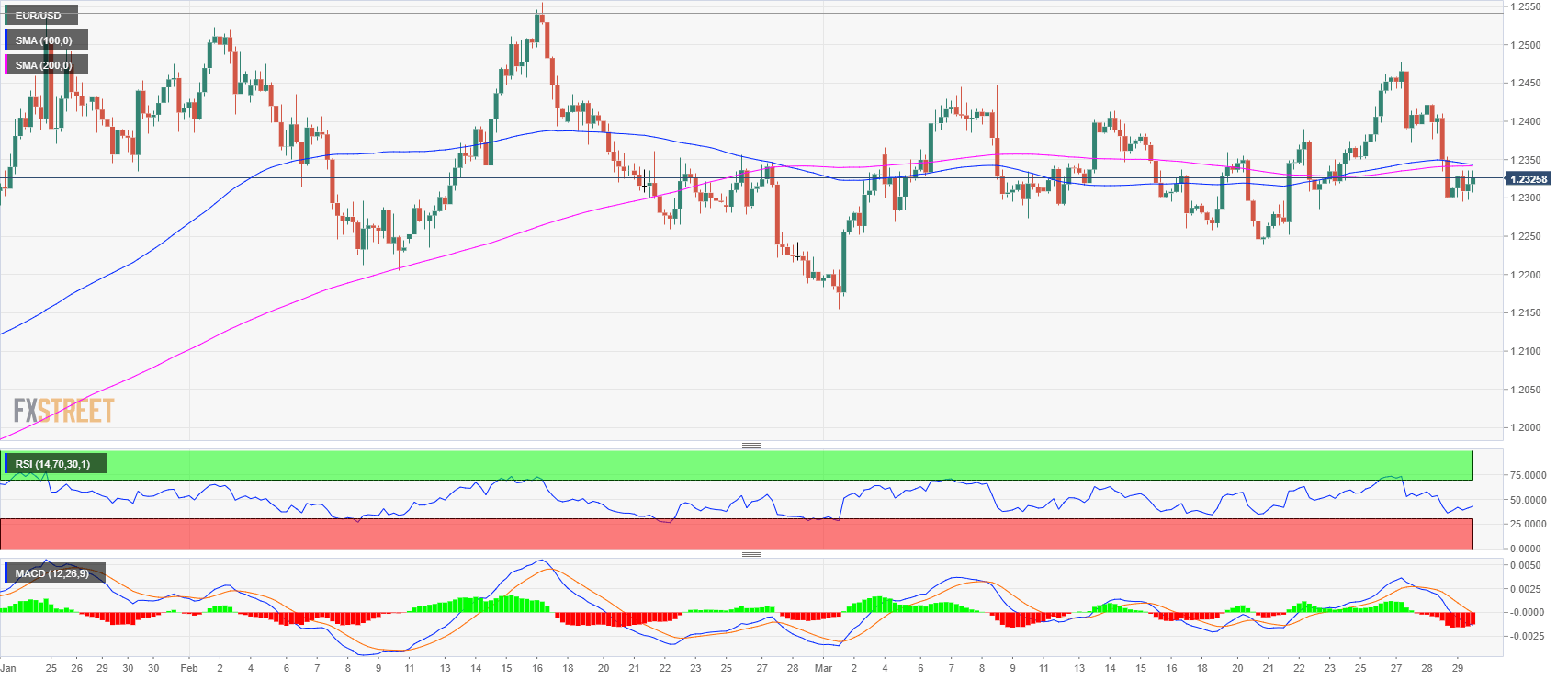

EUR/USD 4-hour chart

The EUR/USD is trading in the 1.23-1.2340 range and the market is deciding whether to continue the slide down to 1.2250 support at last swing low or to break above 1.2340 and move towards the 1.24 handle and the 1.2450 supply level. With the Easter break, it is unclear if the market will have enough volume to move in either direction decisively.