When is the UK GDP and how could it affect GBP/USD?

UK Q4 GDP Overview

The UK docket sees the Q4 GDP revision, which will be published later this session at 0900 GMT. The second estimate of the United Kingdom GDP is expected to confirm a 0.5% growth in the fourth quarter of 2017. The annualized reading is also expected to show that the pace of expansion increased to 1.5% in Q4.

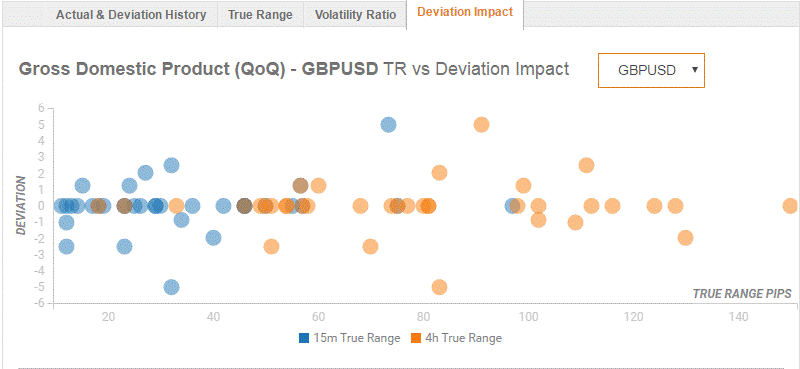

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 2.5 to -2.5, although in some cases, if notable enough, a deviation can fuel movements of up to 70 pips.

How could affect GBP/USD?

The spot could take a further beating on a softer GDP print and test the 1.3850 support zone. On an upside surprise, the GBP/USD pair is likely to extend the ongoing recovery mode in a bid to test the 1.39 handle.

Technically, “the pair is placed near an important support near the 1.3900 handle, marking 50% Fibonacci retracement level of 1.3458-1.4345 up-move. With short-term technical indicators gradually drifting into bearish territory, a convincing break below the mentioned support would turn the pair vulnerable to slide further towards 61.8% Fibonacci retracement level support near the 1.3800 round figure mark en-route an important horizontal support near the 1.3765-60 region. On the upside, any recovery attempts now seem to confront immediate resistance near mid-1.3900s and any subsequent up-move might continue to be capped at the 1.40 handle,” Haresh Menghani, Analyst at FXStreet, writes.

Key Notes

UK: Q4 GDP expected to remain unchanged at 0.5% - TDS

Market movers for today – Danske Bank

About the UK GDP

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).