USD/CAD sinks to lows near 1.3230 post-US data

The greenback remains on the back footing vs. its Canadian peer at the beginning of the week, now dragging USD/CAD to fresh lows near 1.3230.

USD/CAD offered on weak data

Spot met further downside pressure after US durable goods orders surprised markets to the downside today. In fact, orders for long-lasting goods contracted at a monthly 1.1% in May and expanded 0.1% inter-month when excluding the Transportation sector.

Further news from the US docket saw the Chicago Fed National Activity index dropping to -0.26 in May.

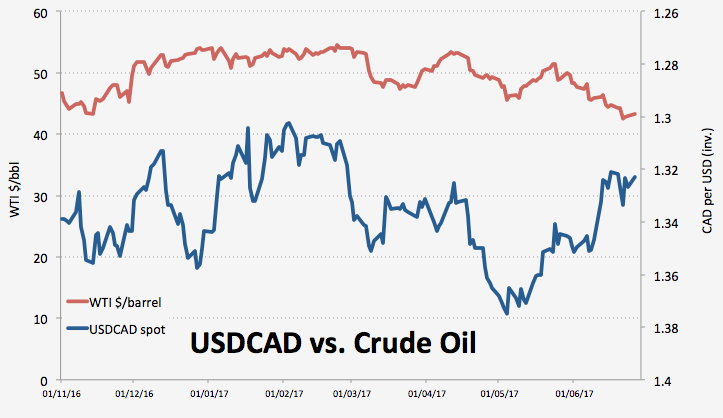

CAD stays strong today following the better tone in crude oil prices, where the barrel of West Texas Intermediate is extending its decent recovery above the key $43.00 mark, or 3-day peaks. Recall that prices for the WTI bottomed out just above the $42.00 mark last week, recording fresh 7-month lows.

In the meantime, spot is fading part of Friday’s advance and trading close to fresh 4-month lows in the 1.3165/60 band seen earlier in the month, always vigilant on crude oil dynamics and the BoC, particularly after recent comments by C.Wilkins and Governor S.Poloz.

USD/CAD significant levels

As of writing the pair is retreating 0.31% at 1.3226 and a break below 1.3189 (low Jun.19) would aim for 1.3163 (low Jun.14) and finally 1.3007 (low Feb.16). On the other hand, the next up barrier is located at 1.3312 (23.6% Fibo of the May-June drop) seconded by 1.3341 (200-day sma) and then 1.3349 (high Jun.21).