Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

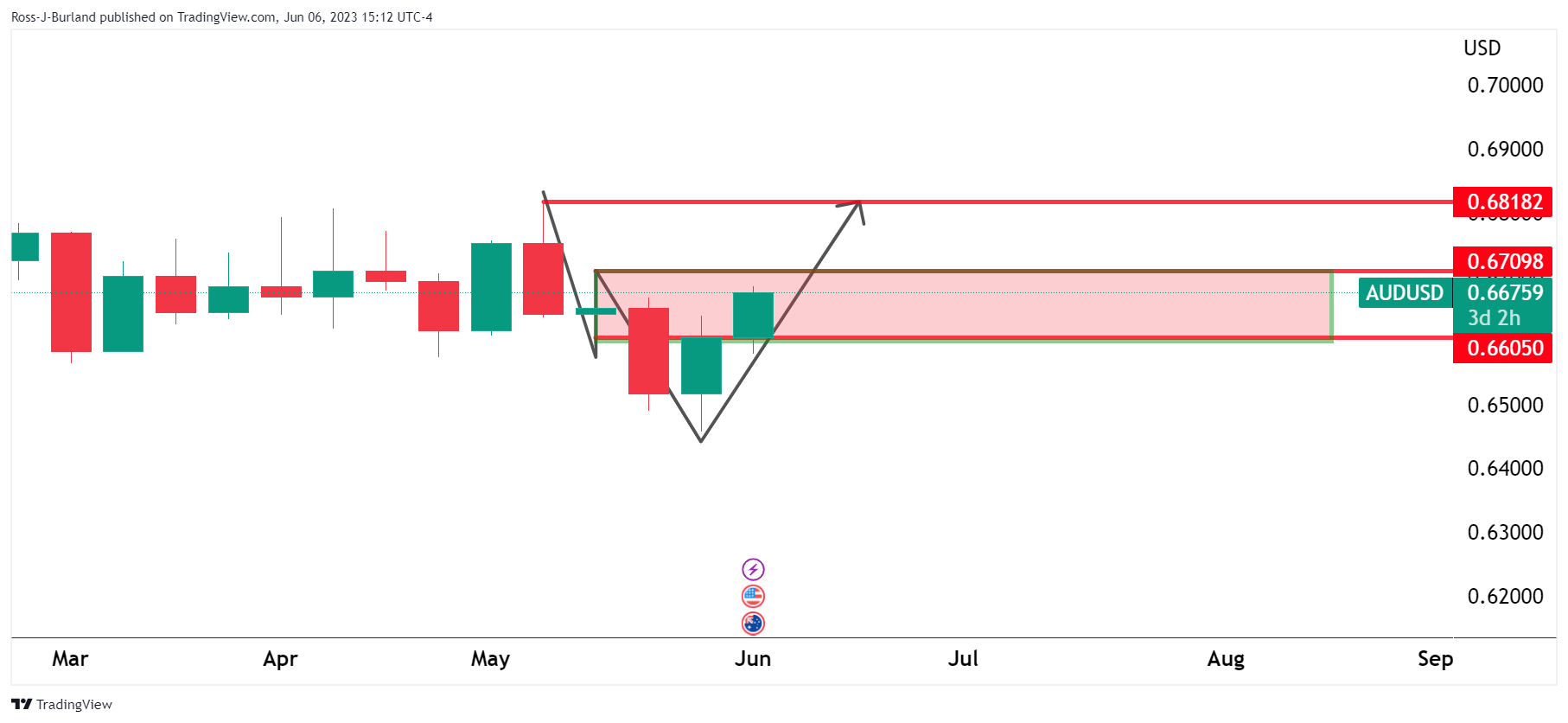

AUD/USD has rallied to the highest since mid-May following the Reserve Bank of Australia (RBA) meeting that raised interest rates. The cash rate is now at an 11-year high of 4.1%. This leaves the technical outlook bullish but there is a risk of a correction, in the meanwhile, as the following illustrates. The major catalyst, if there is going to be a further upside, will be from the Federal Reserve interest rate decision on June 14 and the outcome. A dovish resolve would be expected to support AUD/USD bulls on their path higher.

The weekly trajectory is to the upside in a W-formation with the last leg with plenty still to go as it takes on the neckline resistance currently:

Zooming in, the daily chart shows the price in a W-formation also, but this could be about to complete with a pullback to restest the commitment of the bulls. A declaration of the momentum with a creeping correction into the Fed meeting could be on the cards.