EUR/USD bears could be lurking up high in the peak formations

- EUR/USD bulls move back into the peak formation.

- Federal Reserve´s dovish hike weakened the US Dollar.

EUR/USD has been attempting to run higher on Wednesday and reached the 1.1090s and a previous resistance area. The Euro ran higher on the back of what was traded as a dovish 25 basis point hike from the Federal Reserve ahead of tomorrow's European Central Bank meeting.

At the time of writing, EUR/USD is trading at 1.1055 as the US Dollar scrambled back from the edge of the abyss following a balanced press conference from the Federal Reserve´s, Jerome Powell. The following are the key takeaways from the event:

Fed´s statement, key takeaways

- Fed drops language that it anticipates more policy firming may be appropriate to attain a sufficiently restrictive stance.

- Will continue reducing the balance sheet as planned.

- Job gains have been robust and inflation remains elevated.

- Tighter credit conditions are likely to weigh on the economy, hiring, and inflation.

- Fed says the vote in favor of the policy was unanimous.

- Fed repeats us banking system is sound and resilient.

- In determining the extent to which additional policy firming may be appropriate, it will take into account tightening.

The Federal Reserve removed the prior language that signaled more hikes were coming. Instead, the statements say the extent to which more firming is needed hinges on the economy. Consequently, Fed futures are pricing in a pause in June and July and rate cuts in September.

However, Fed´s Chairman Jerome Powell was questioned by the press as to whether rate cuts are on the way, to the contrary, he said it would not be appropriate for us to cut rates when he outlined the conditions of high inflation whereby the Fed would need to stay on its rate hiking course.

´´Rate cuts would be inappropriate given our belief that inflation will take some time to subside,´´ Fed Chairman said.

Consequently, the US Dollar was thrown around as follows:

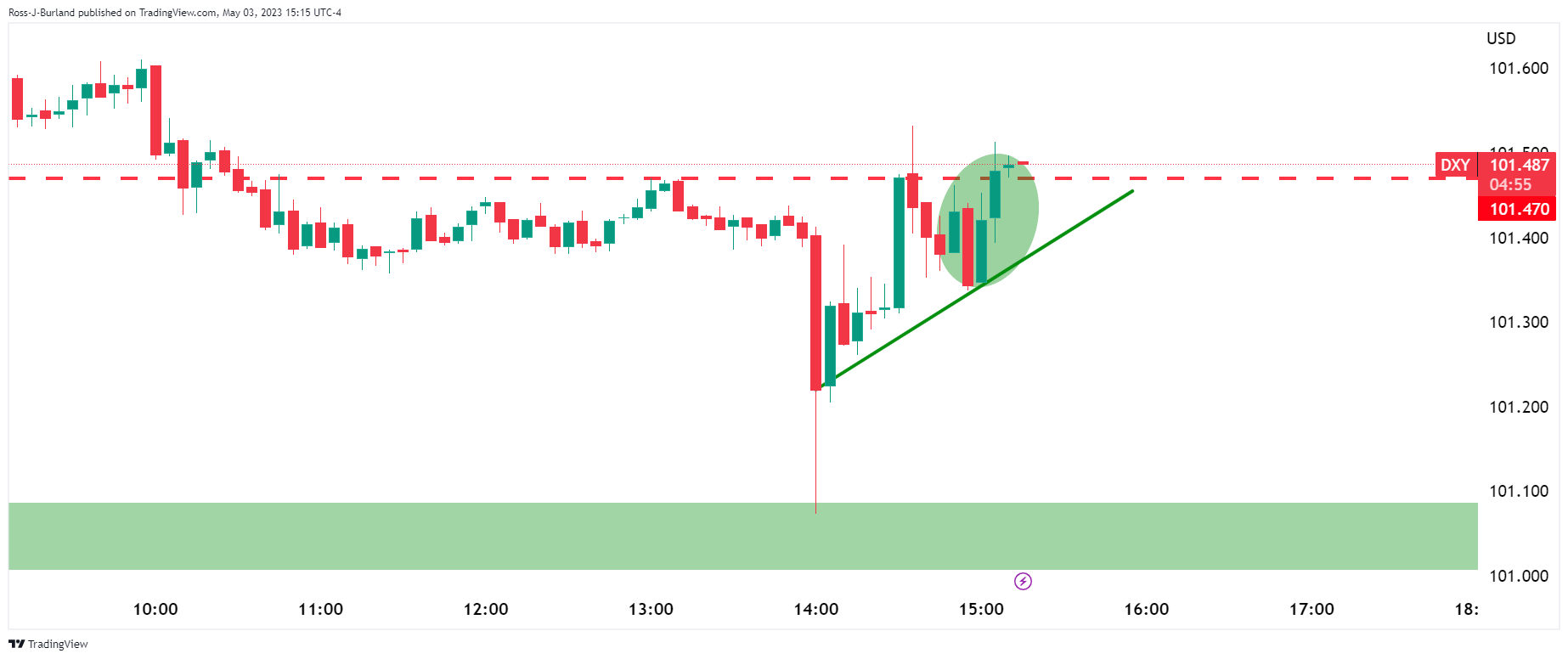

US Dollar, DXY chart

The eclipsed price action above on the 5min chart was the reaction to Powell´s back peddling when it came to rate cuts. The price to the downside was the market's initial reaction to the prospects of a pivot from the Fed. The line in the sand is around 101.50:

The European Central Bank is the next main highlight for EUR/USD.

´´ It is our view that the ECB will announce three more 25 bps rate hikes in May, June and July,´´ analysts at Rabobank said.

´´While the USD has failed to gain a safe-haven bid this week on concerns about US regional banks. Fresh stresses elsewhere could yet promote a move back to USDs. We see risk of a move back to the EUR/USD 1.06 in H2 this year,´´ the analysts concluded.

EUR/USD technical analysis

The EUR/USD 4-hour chart is pretty messy with the price breaking structures on the downside and coming right back into the peak formations again. With that being said, a break above 1.1100 will be bullish while a break below 1.1020 would be bearish.