Nuestros mejores spreads y condiciones

Acerca de la plataforma

Acerca de la plataforma

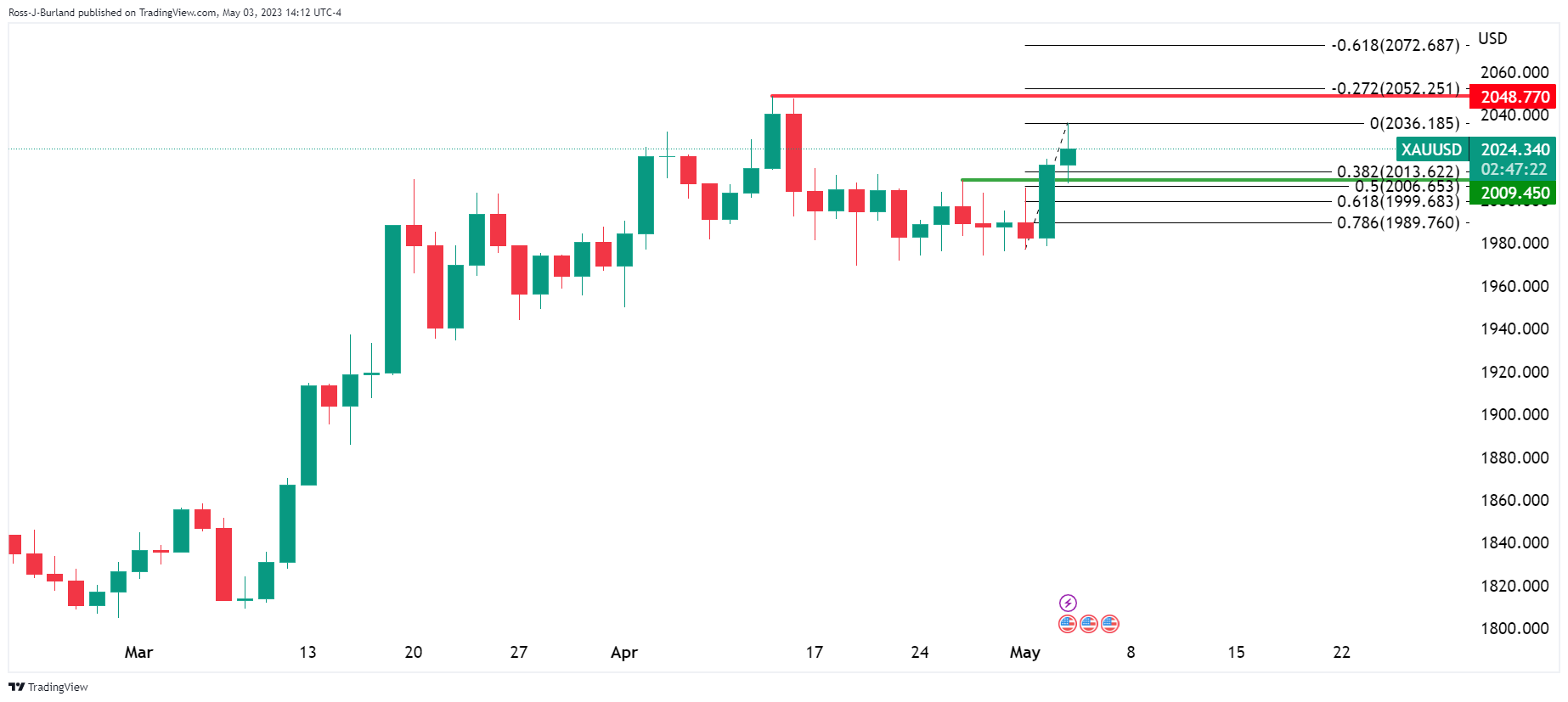

The Gold price jumped to a high of $2,036.15 and counting on the back of the initial reaction to the Federal Reserve rate hike of 25 basis points and accompanying announcements within its statement.

The US Dollar has dumped and is down some 0.8% at the time of writing as the central bank removes the prior language that signaled more hikes were coming. Instead, the statements say the extent to which more firming is needed hinges on the economy. Consequently, Fed futures are pricing in a pause in June and July and rate cuts in September.

All in all, the Fed has opened the door to a rate-hike pause, and Gold price is reacting in kind.

Markets will now await the Chairman, Jerome Powell who will be speaking in the press conference.

Watch live: Fed chair Jerome Powell

The bulls are in the market but the volatility is rife and there are prospects of a move lower into the in-the-money longs from the start of the US session if the bears can get below $2,021 on hawkish rhetoric from Jerome Powell: